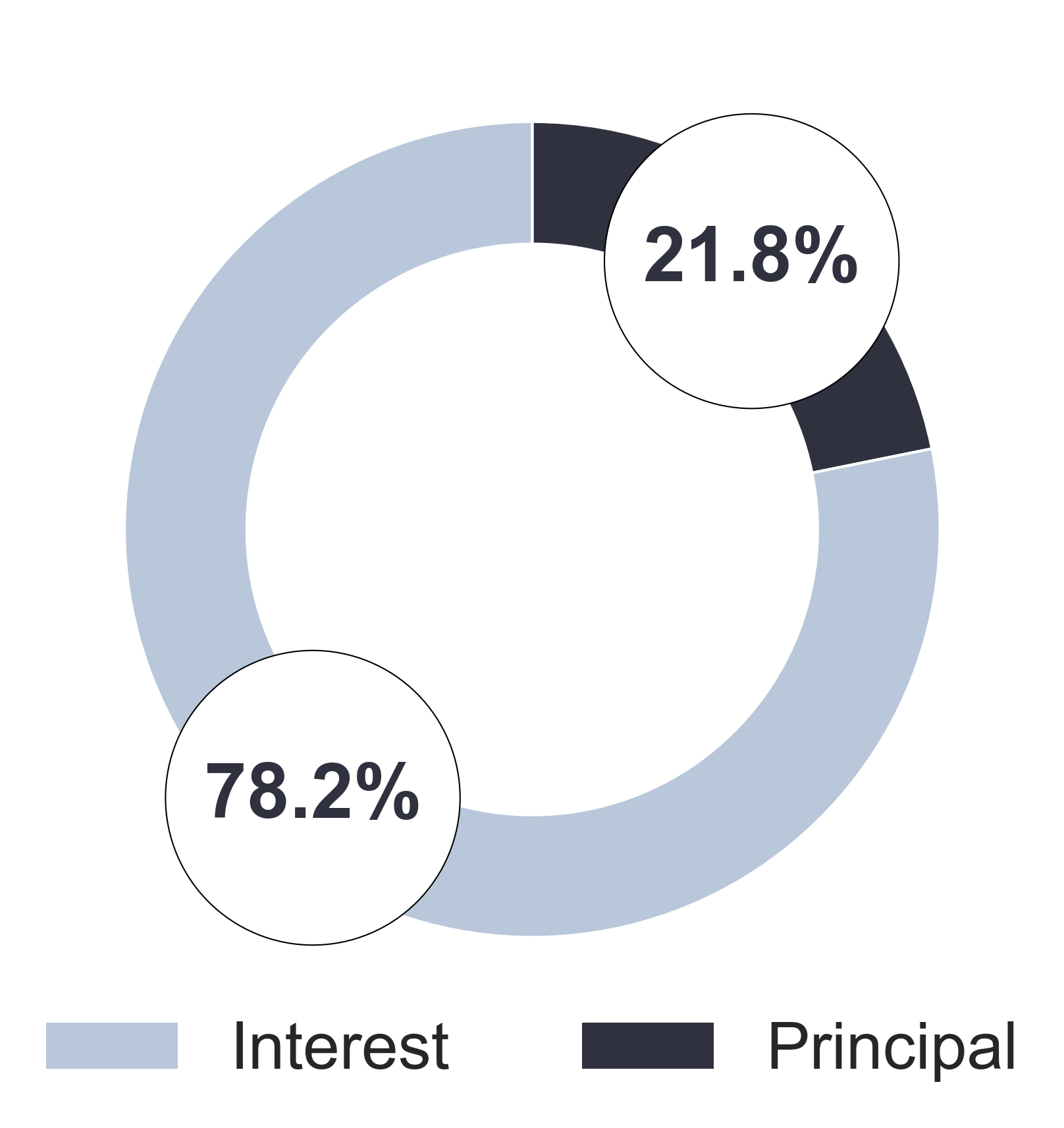

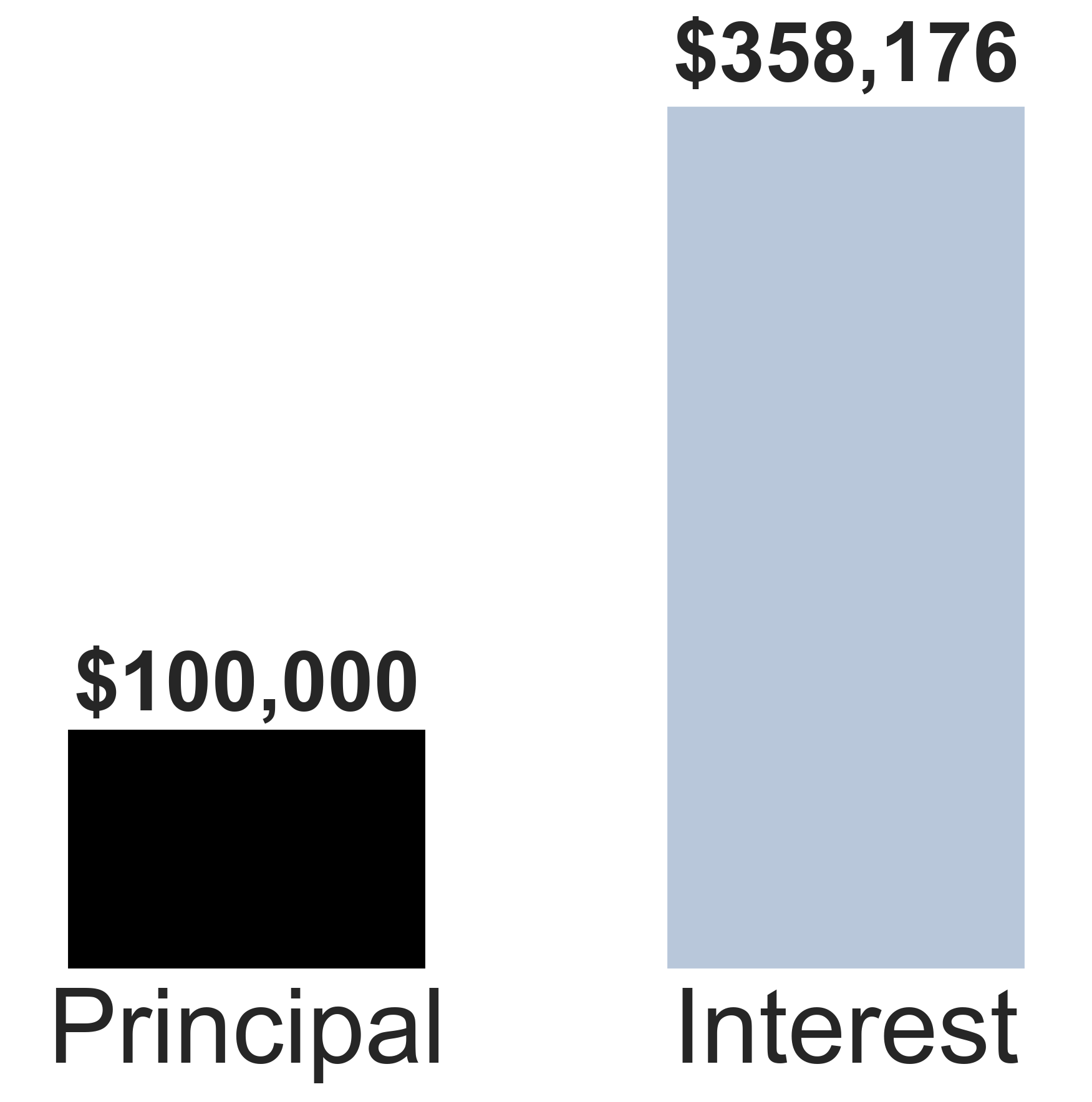

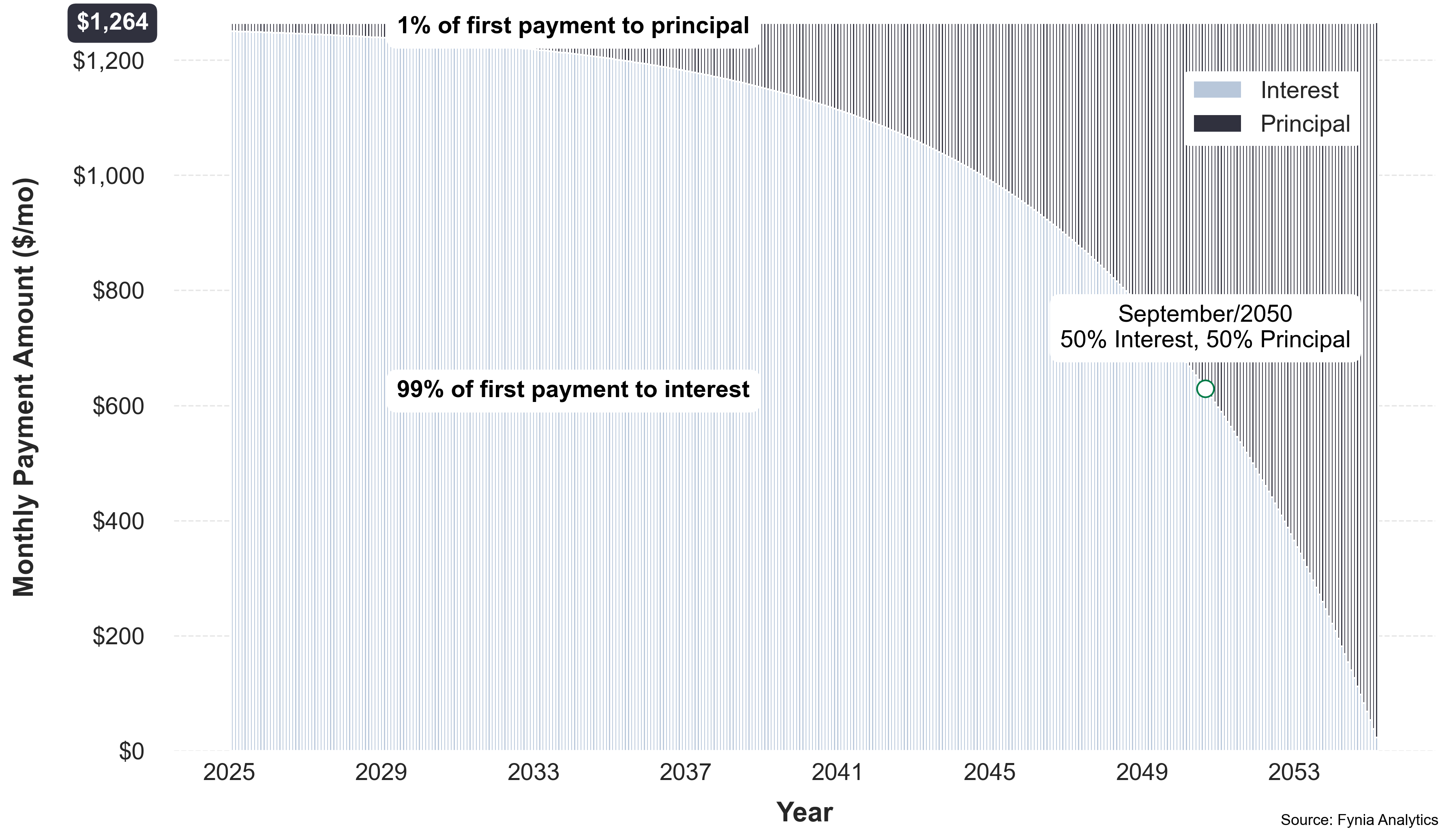

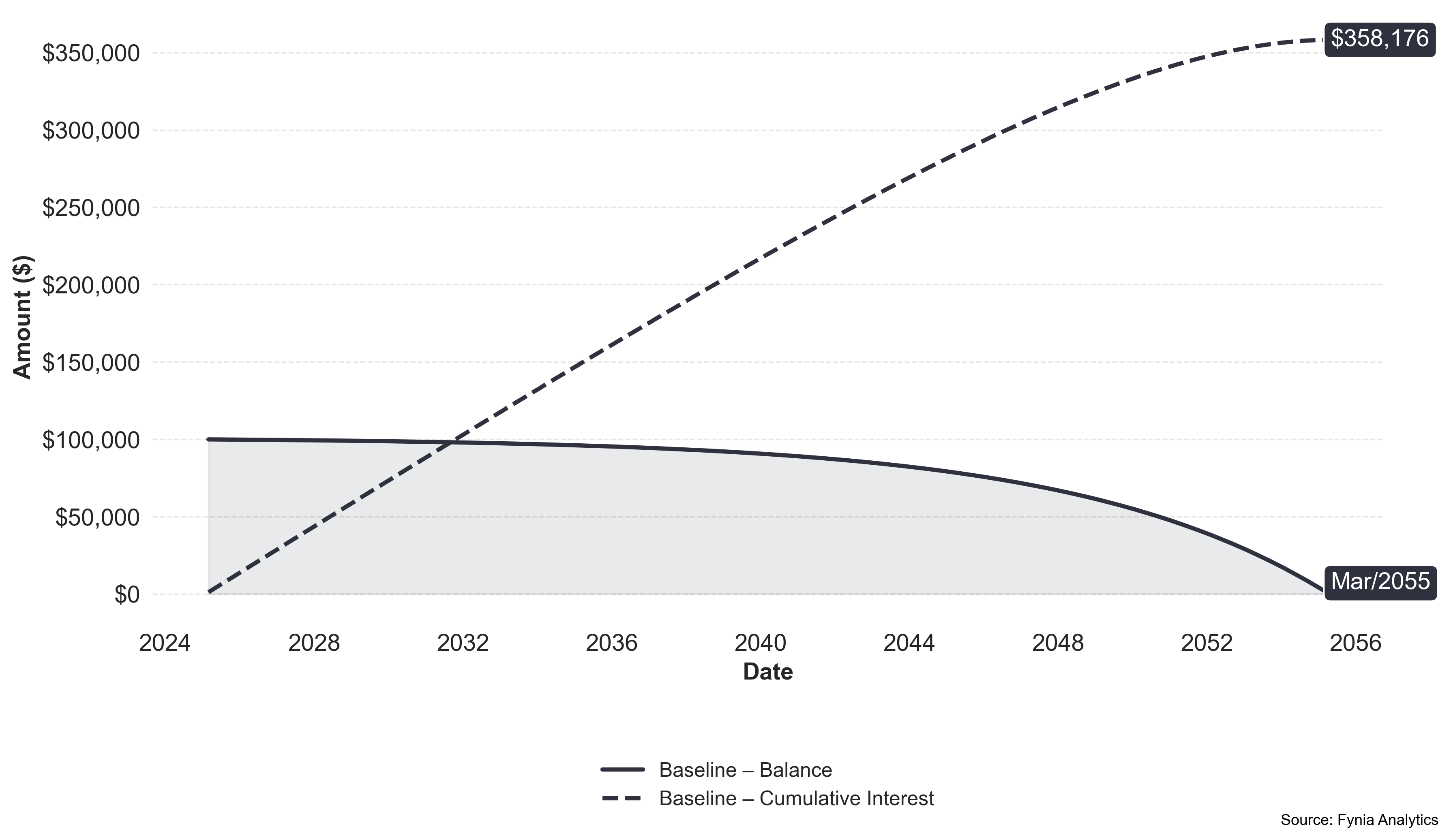

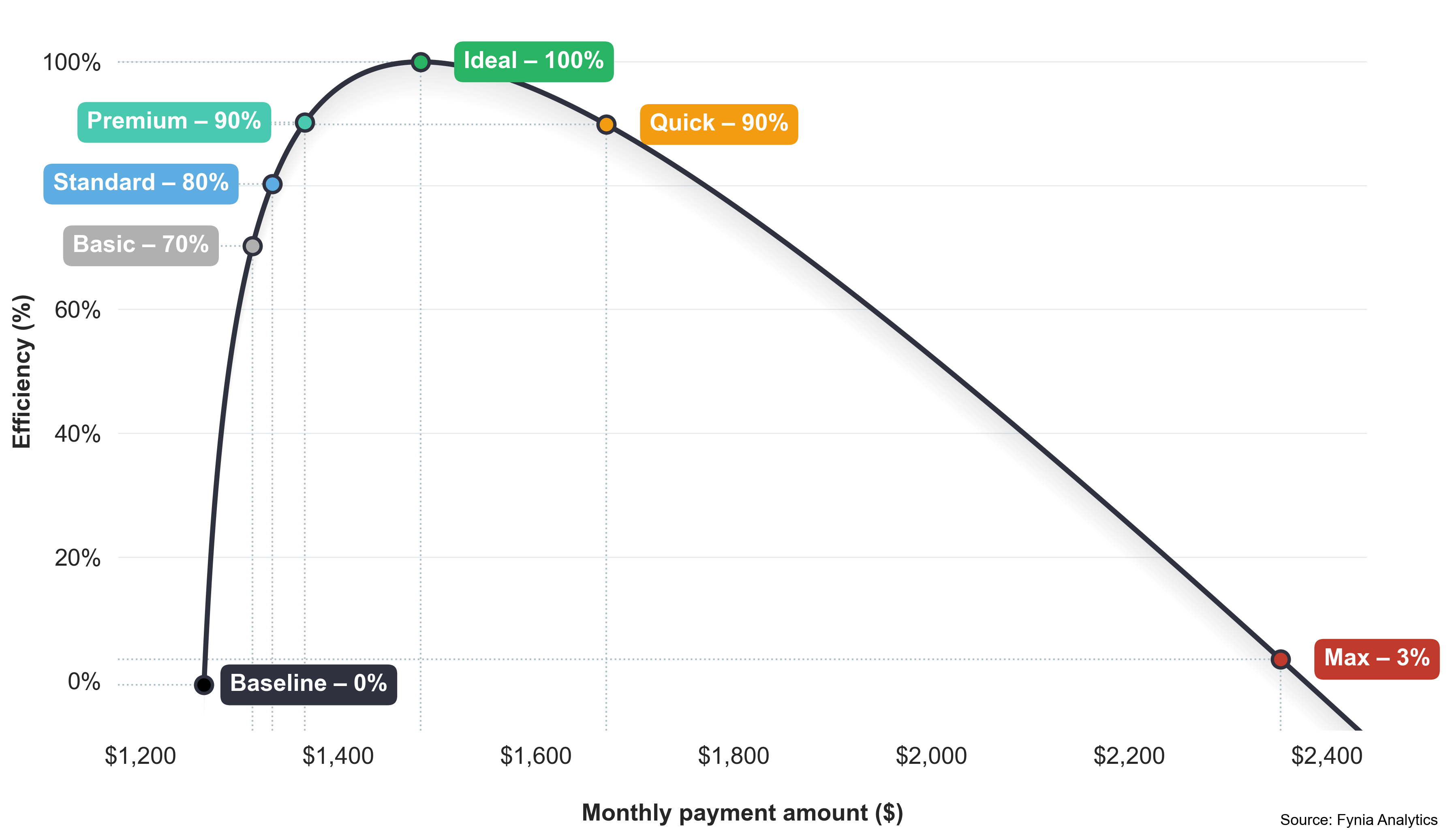

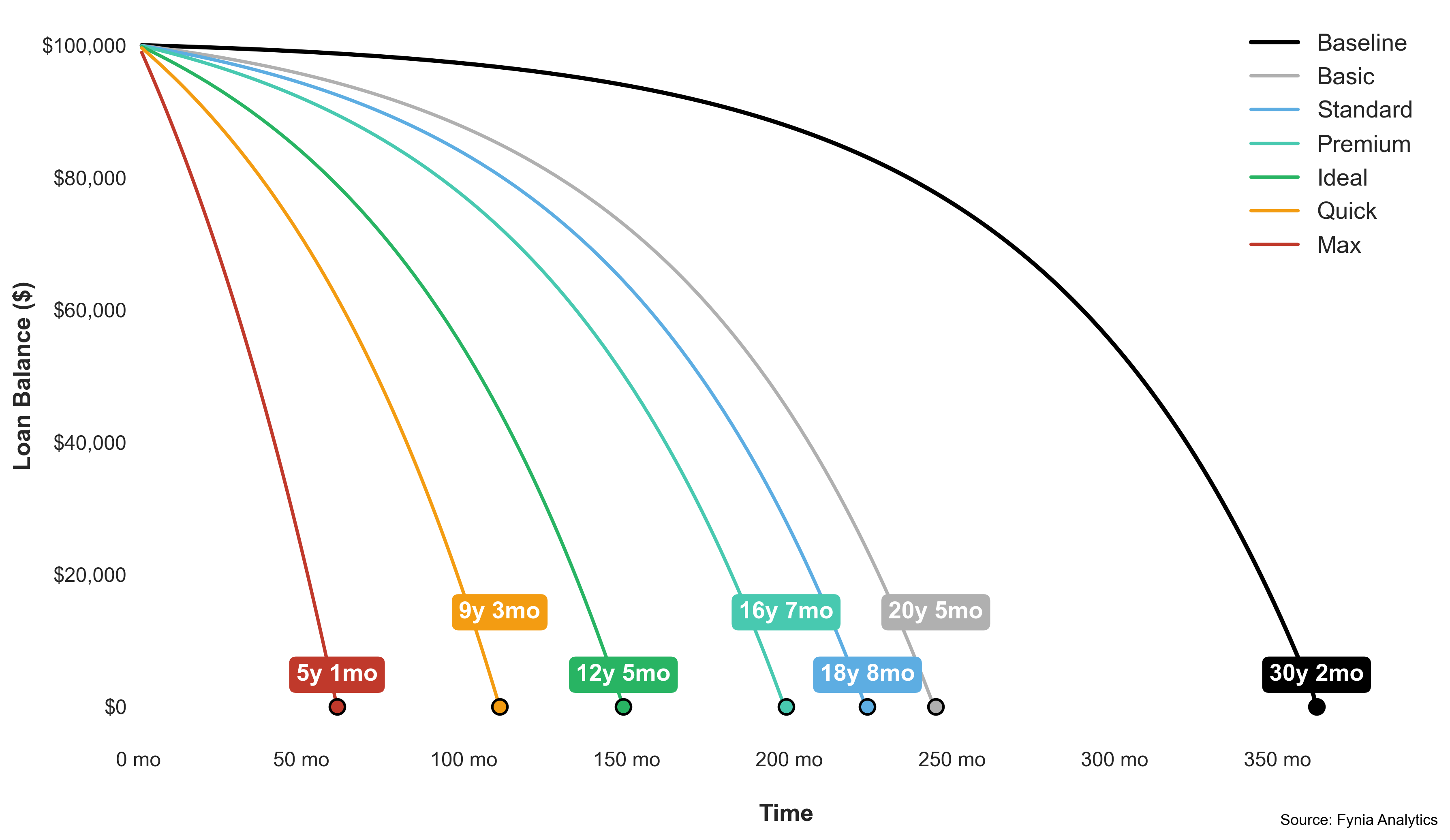

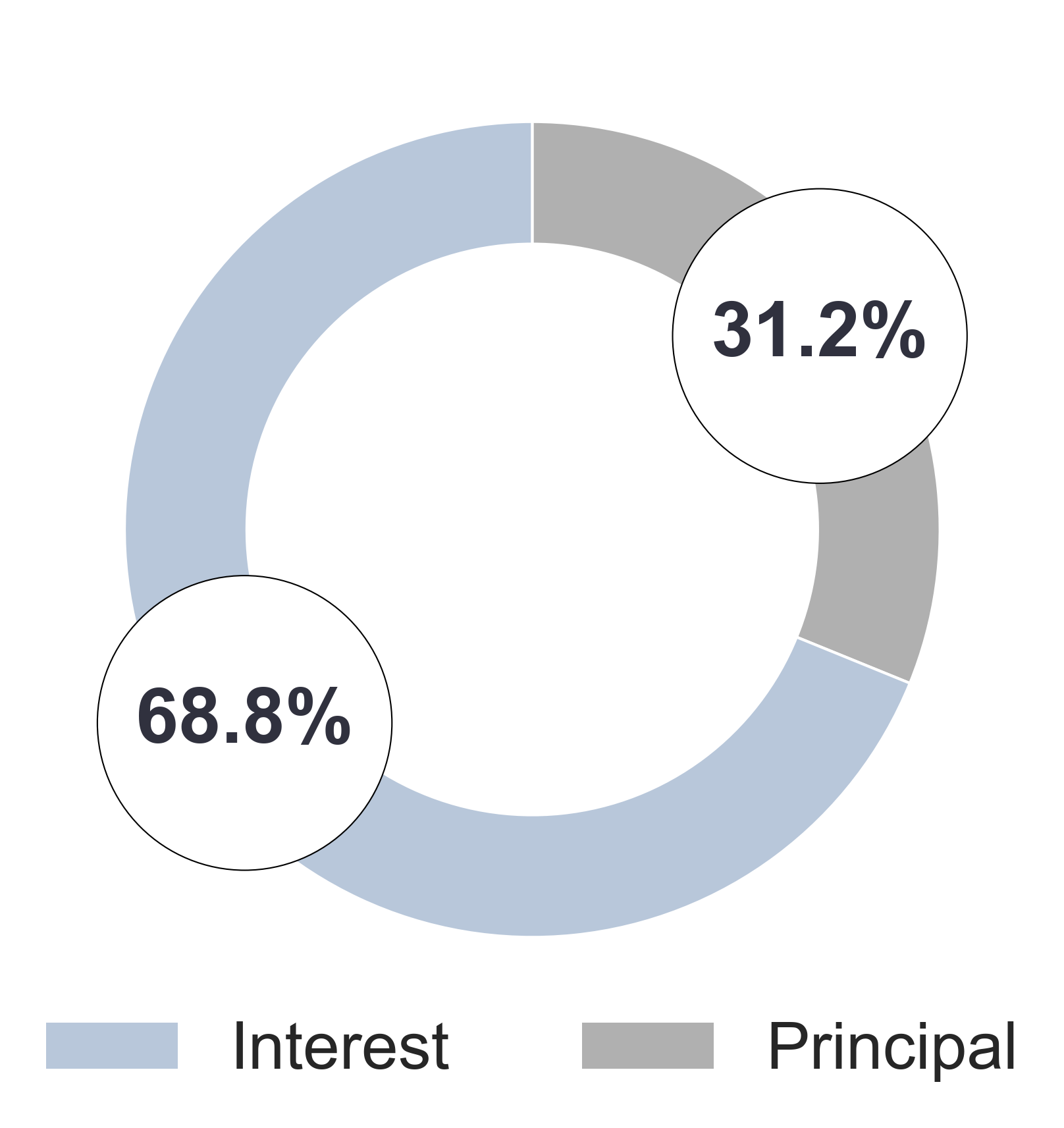

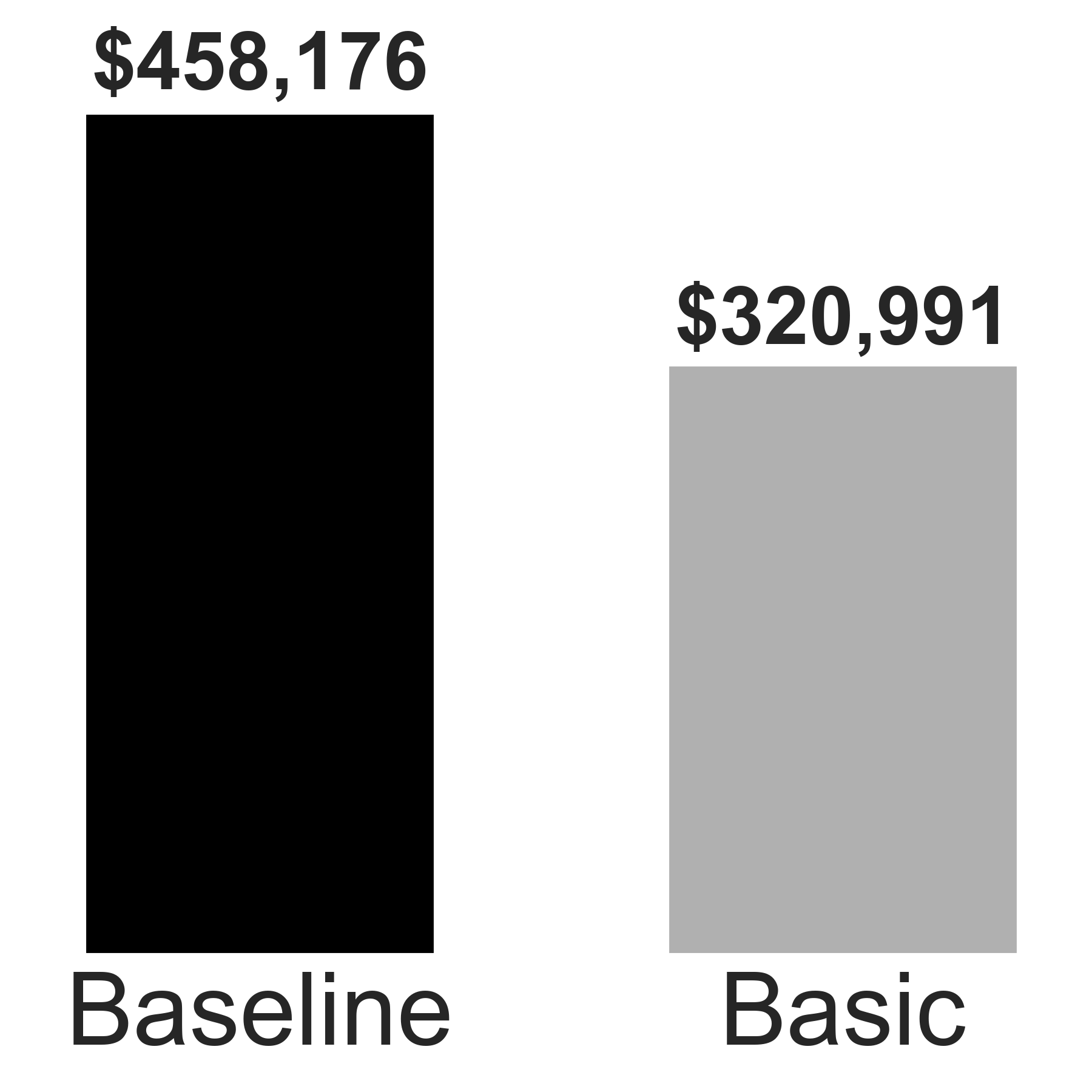

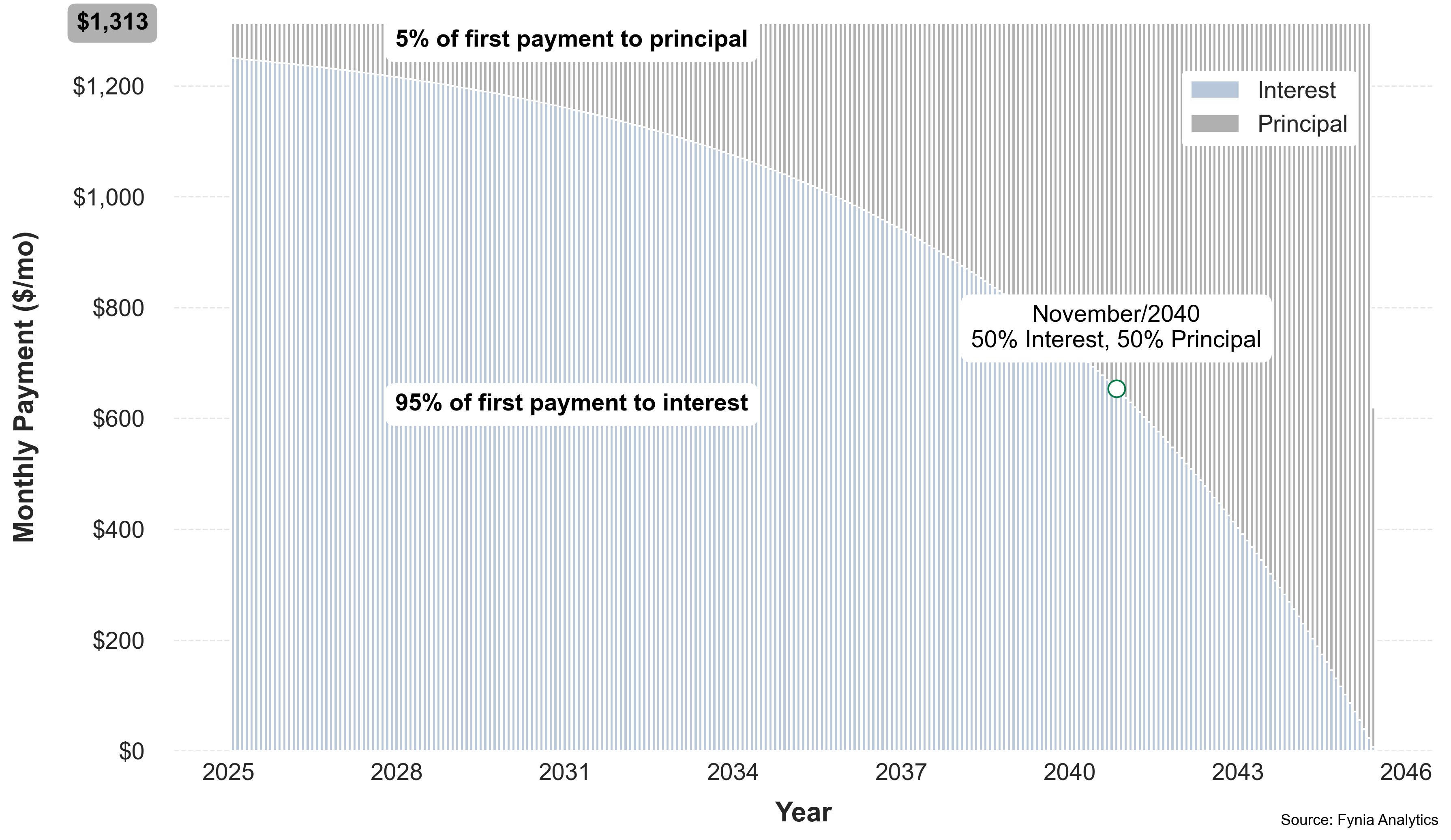

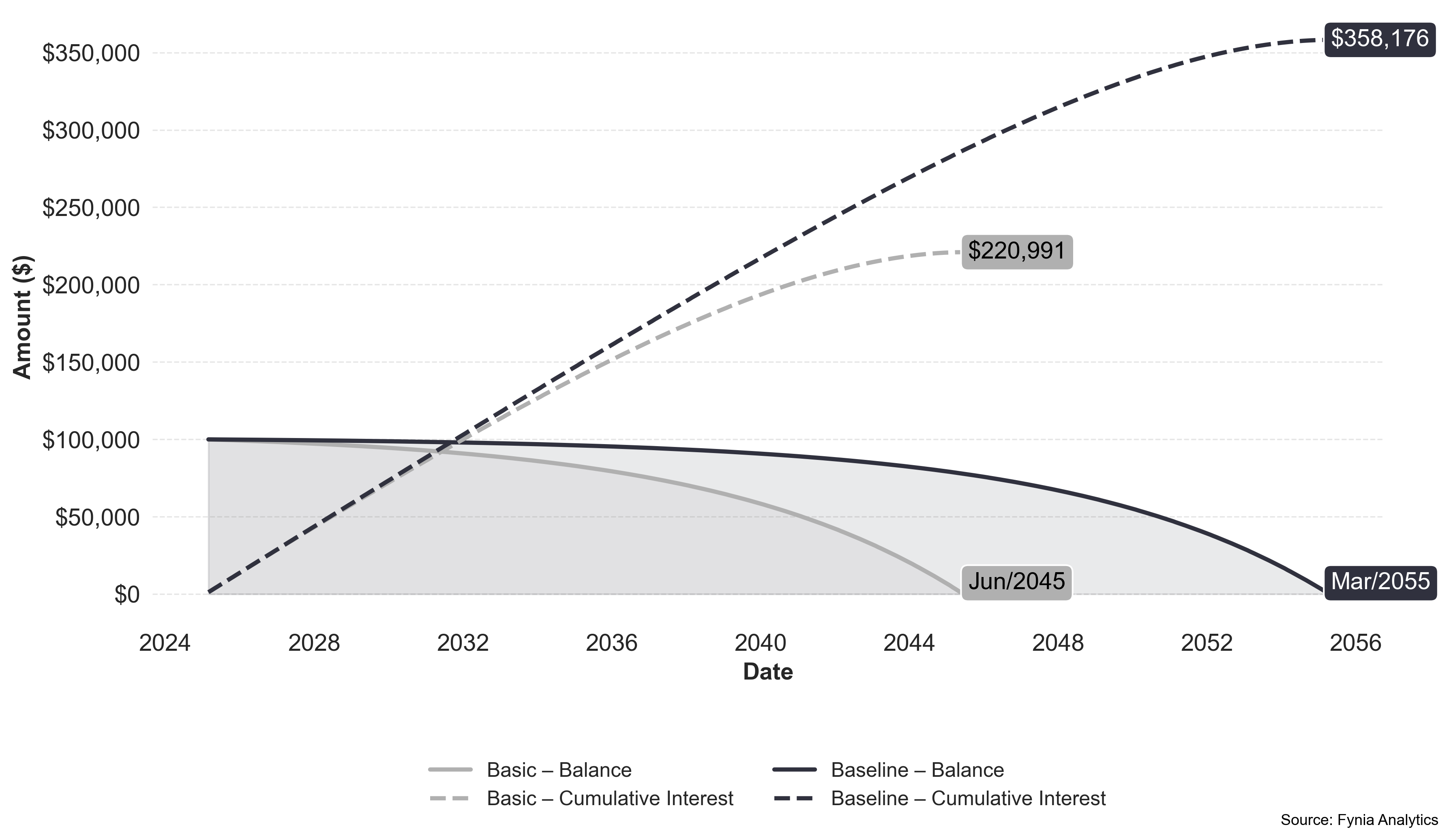

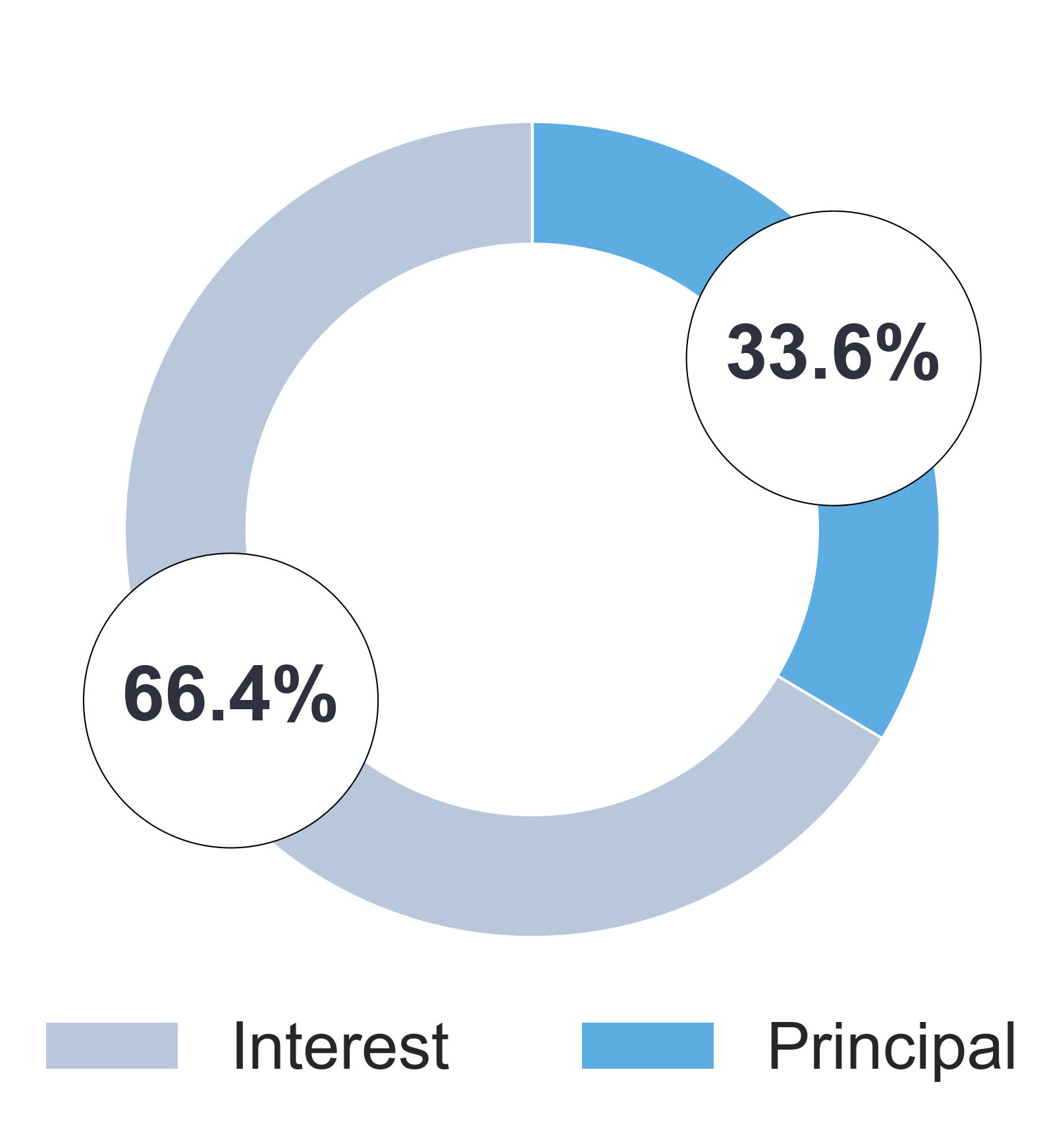

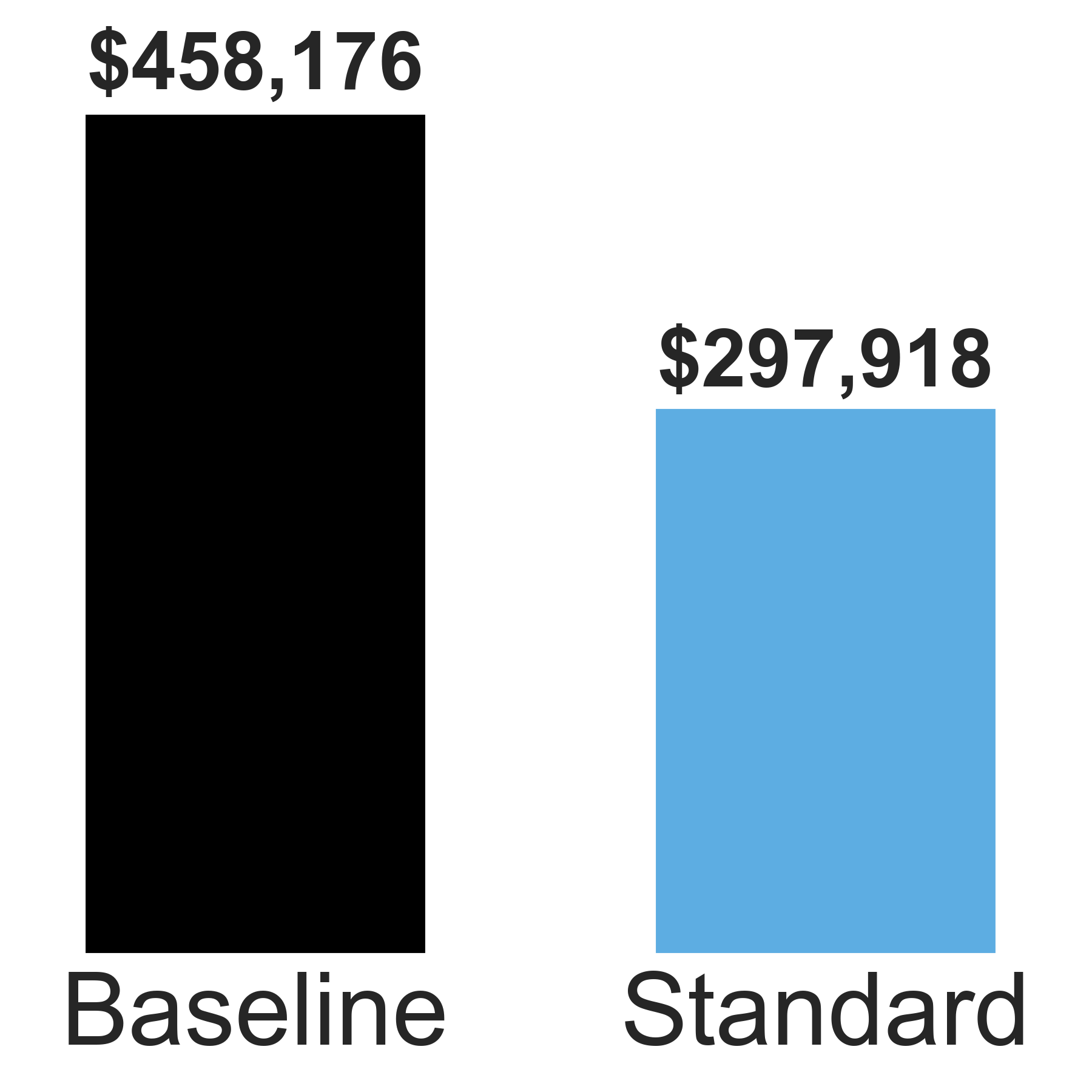

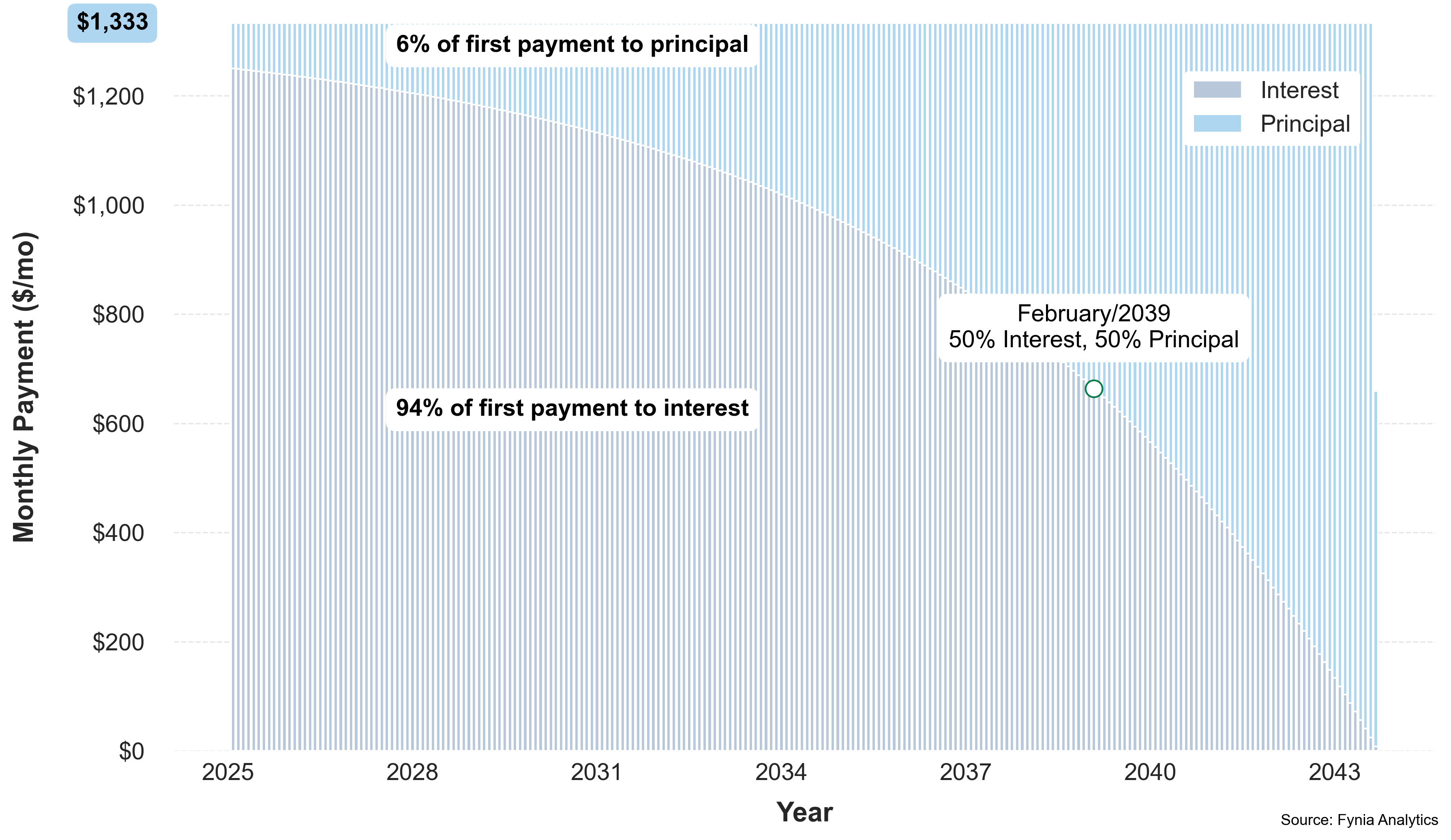

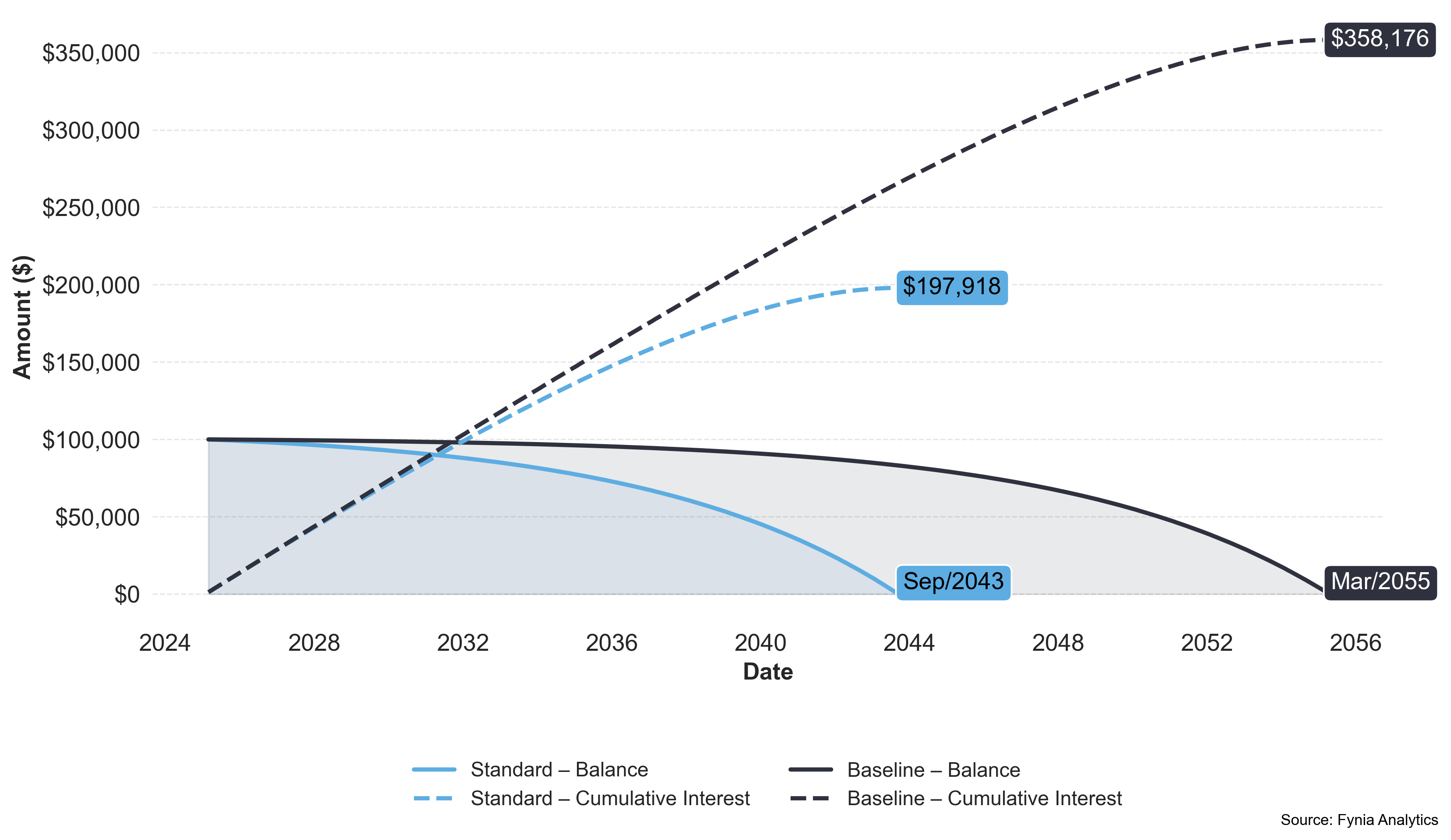

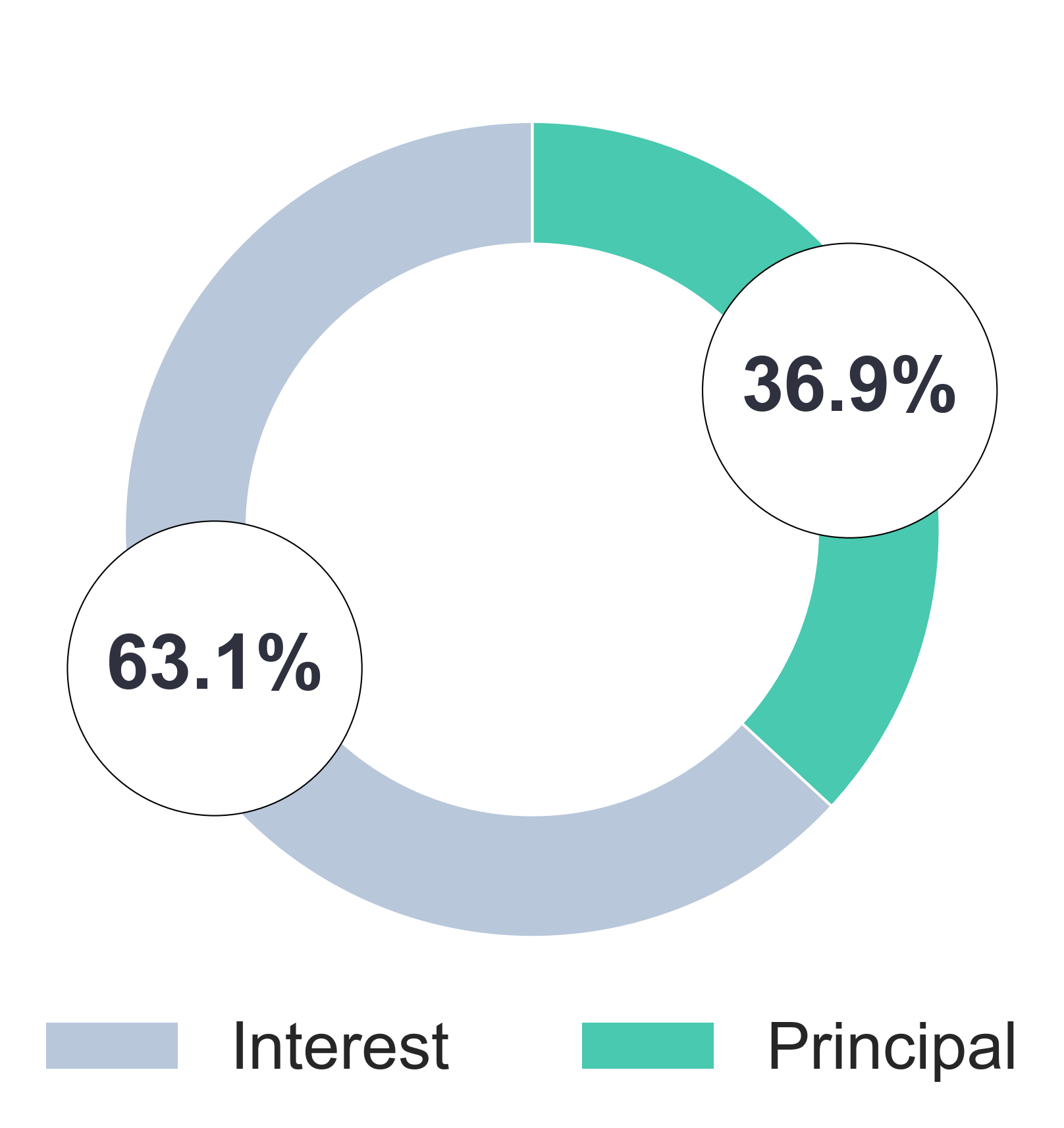

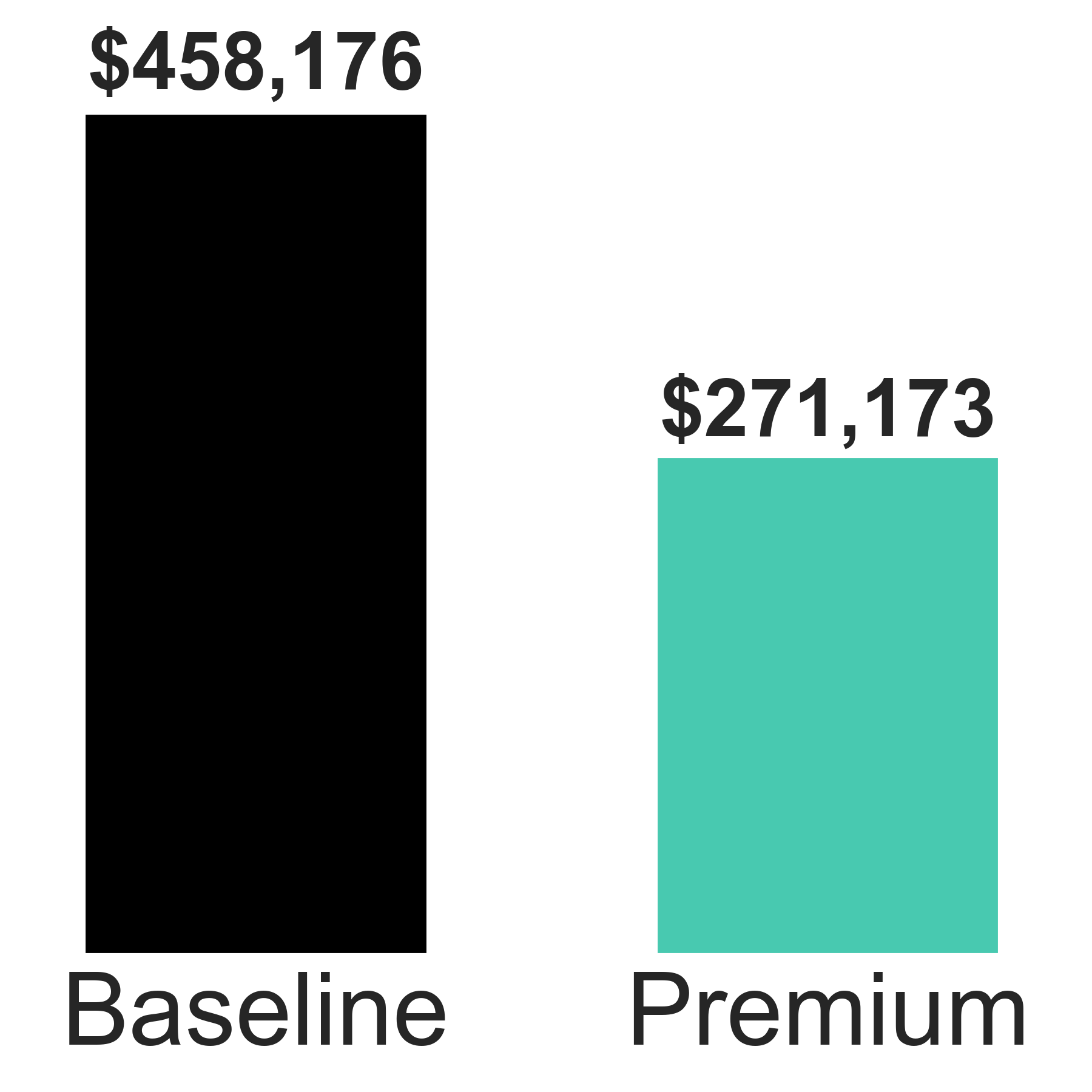

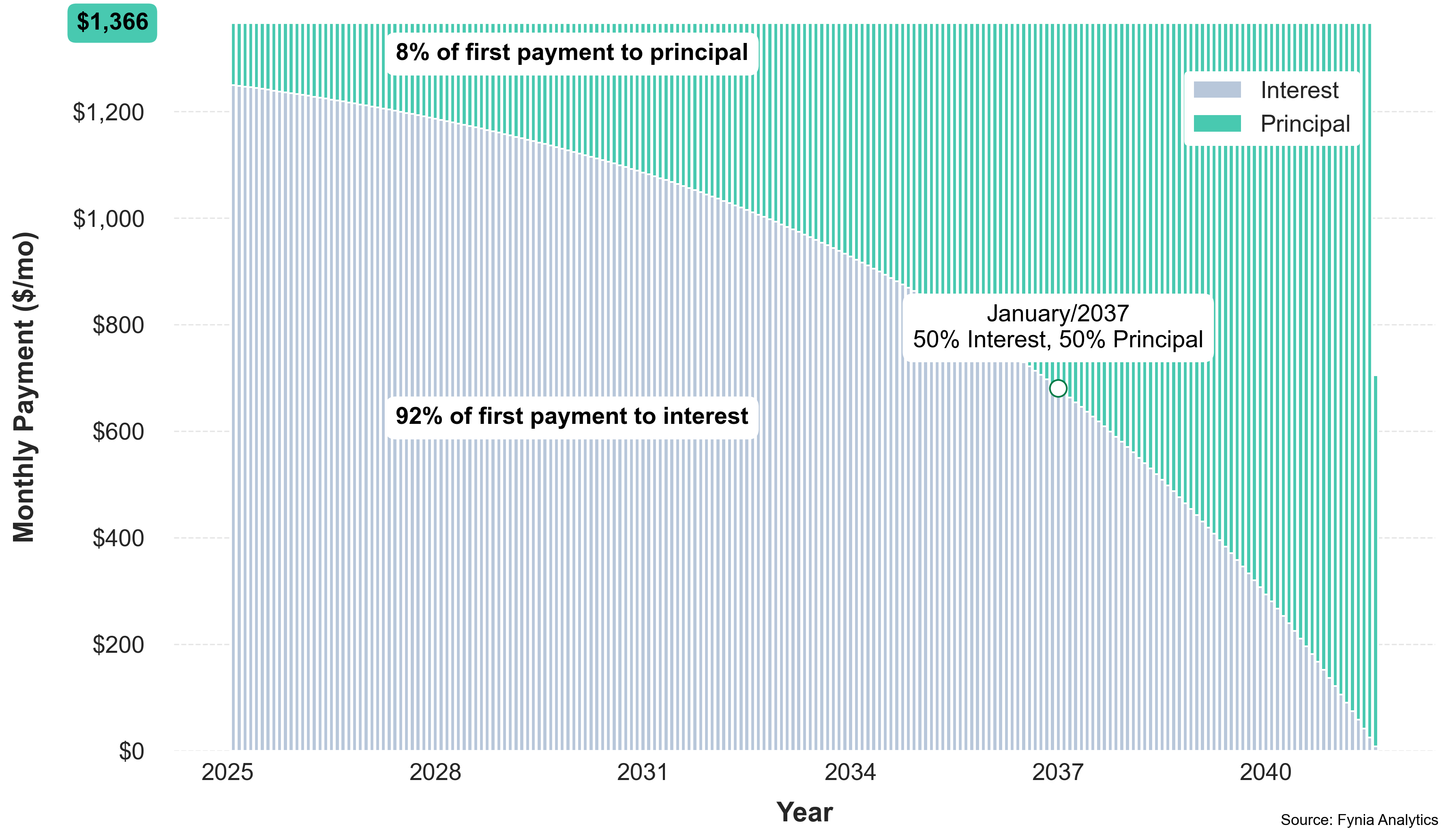

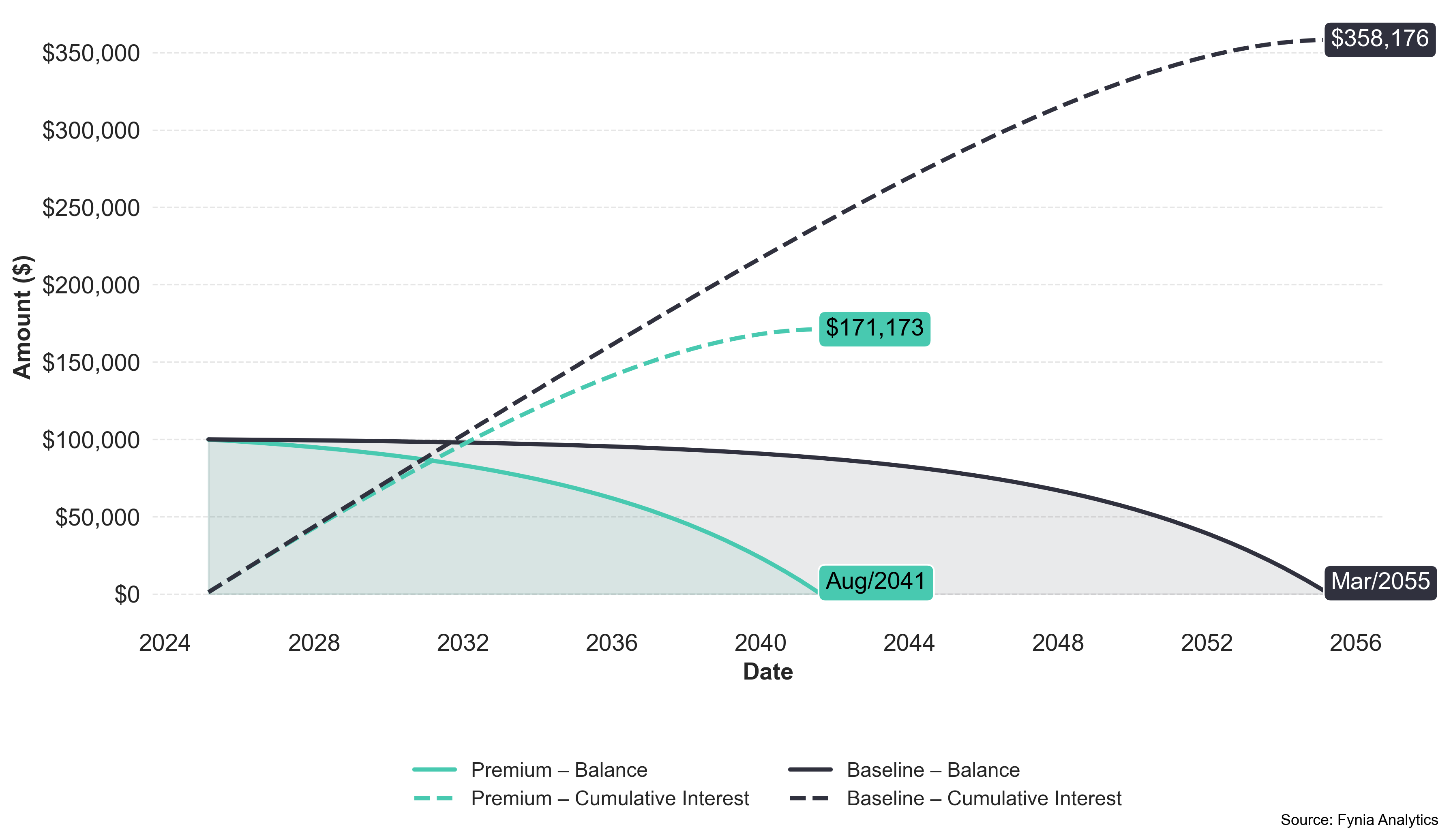

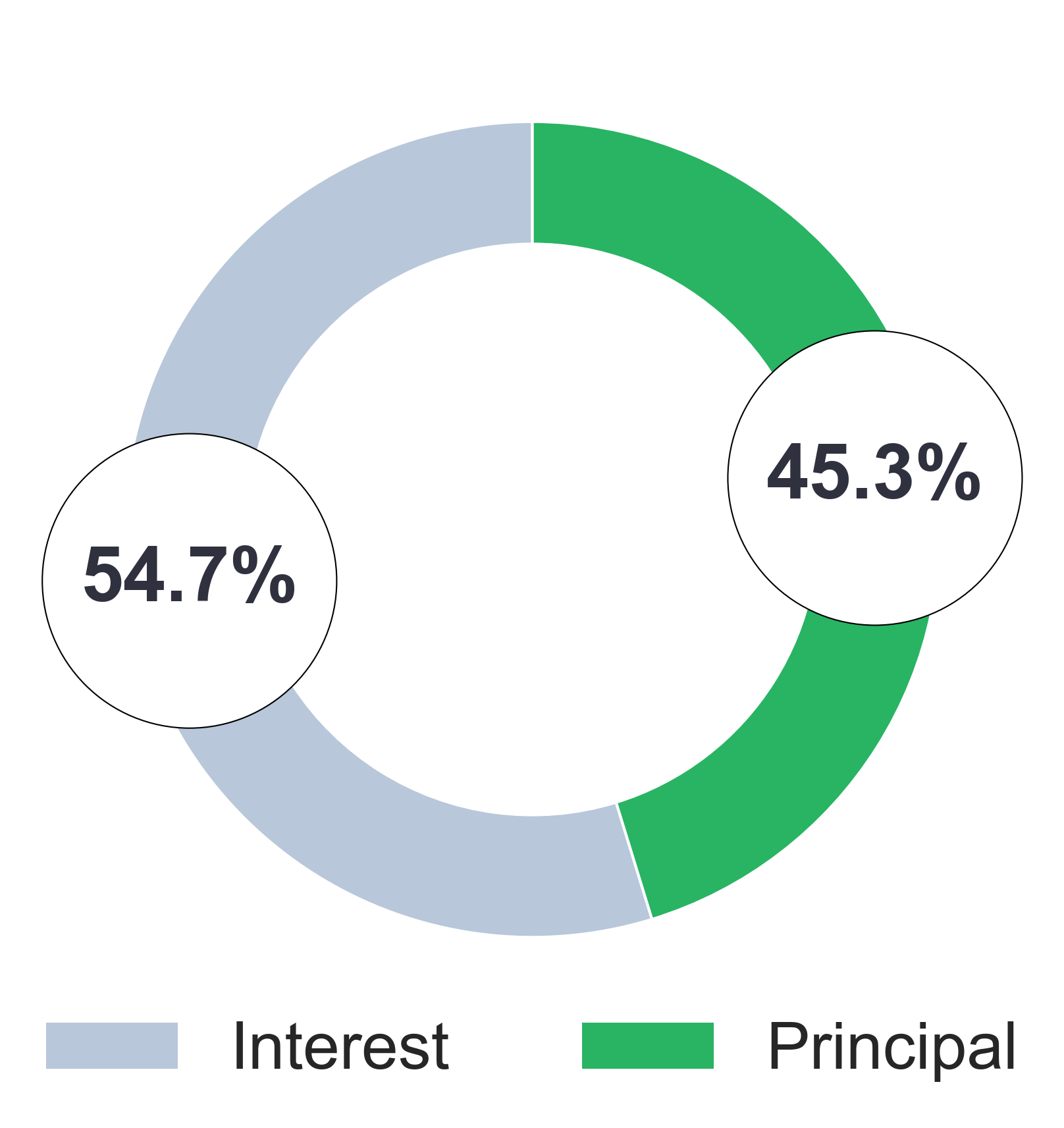

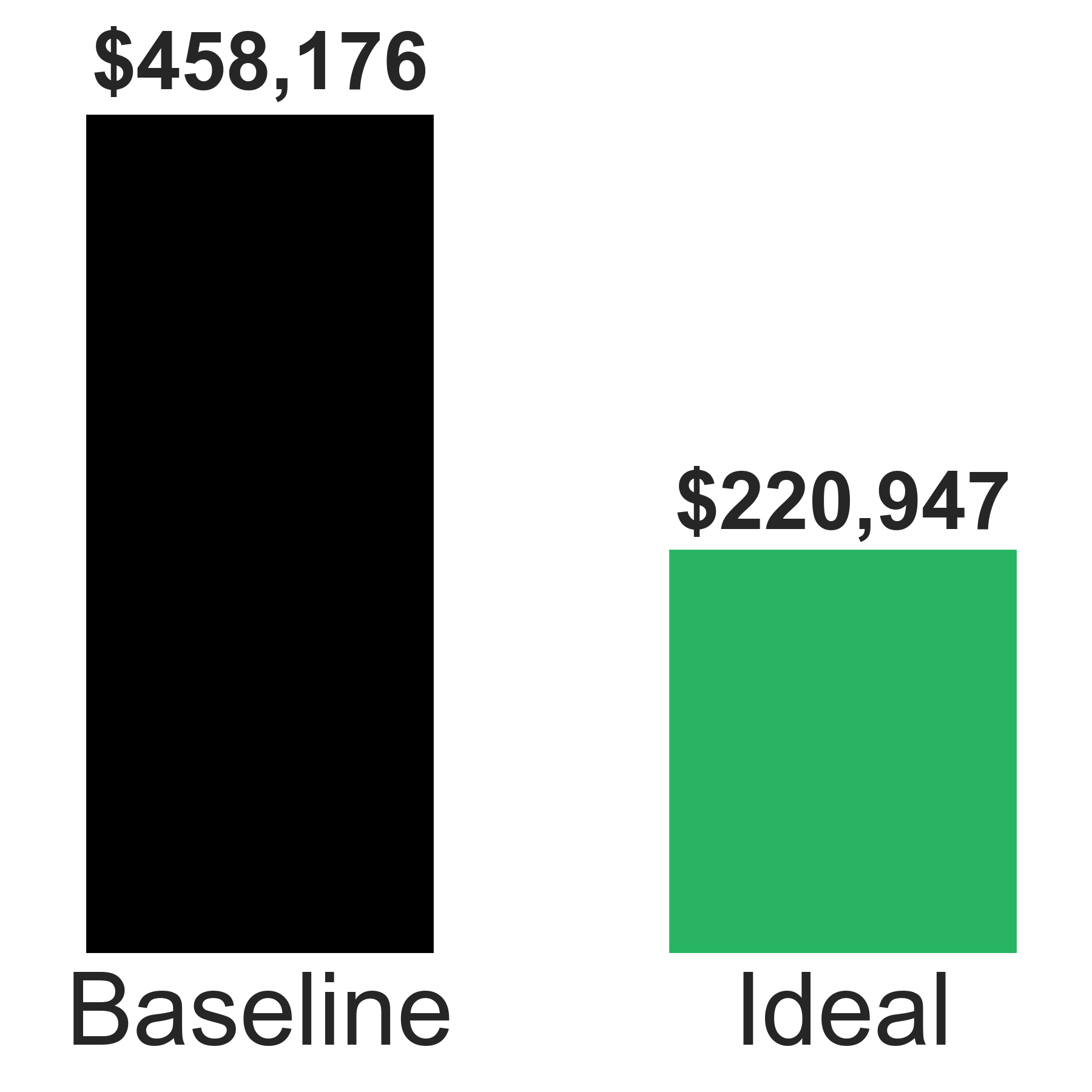

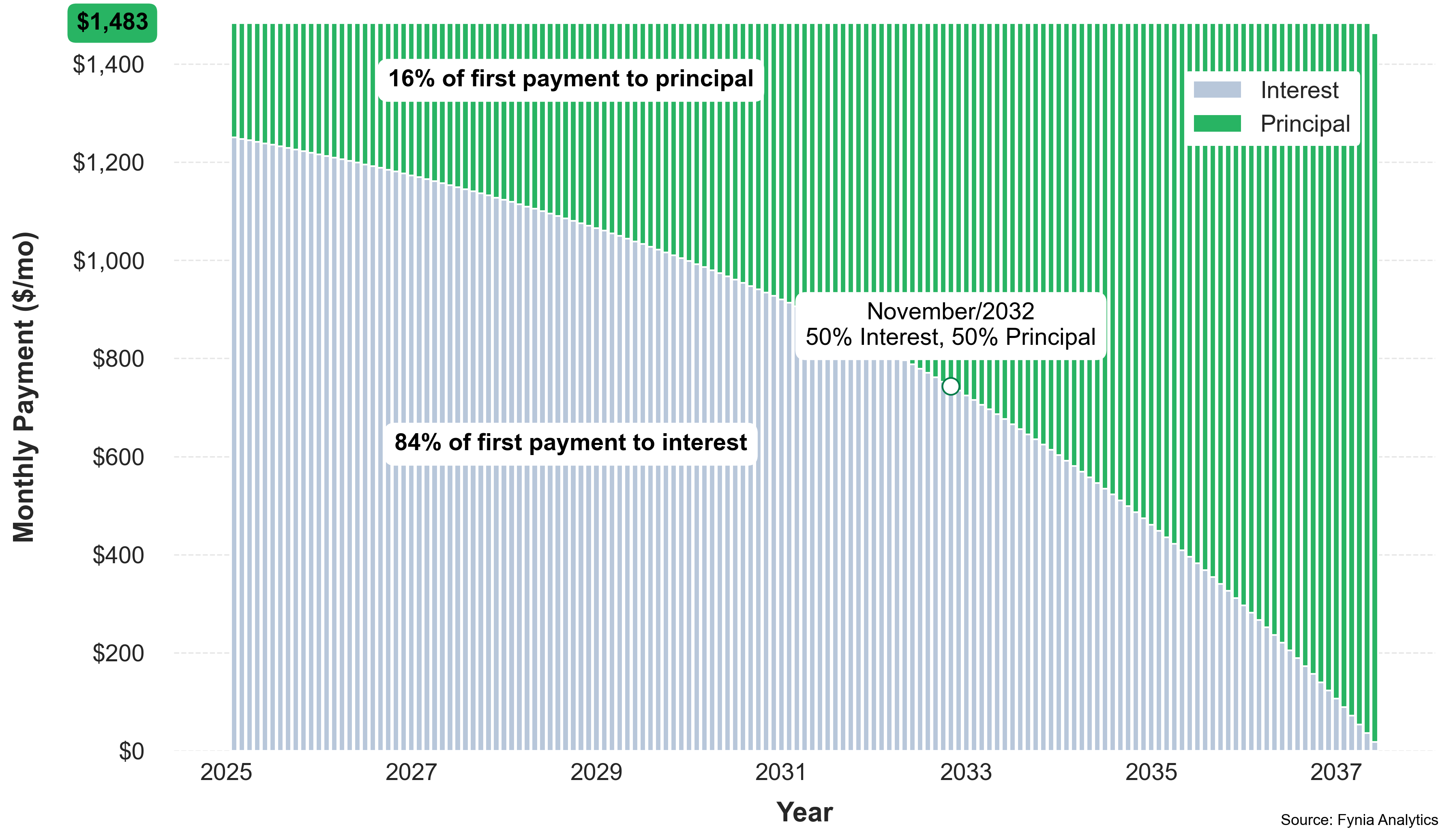

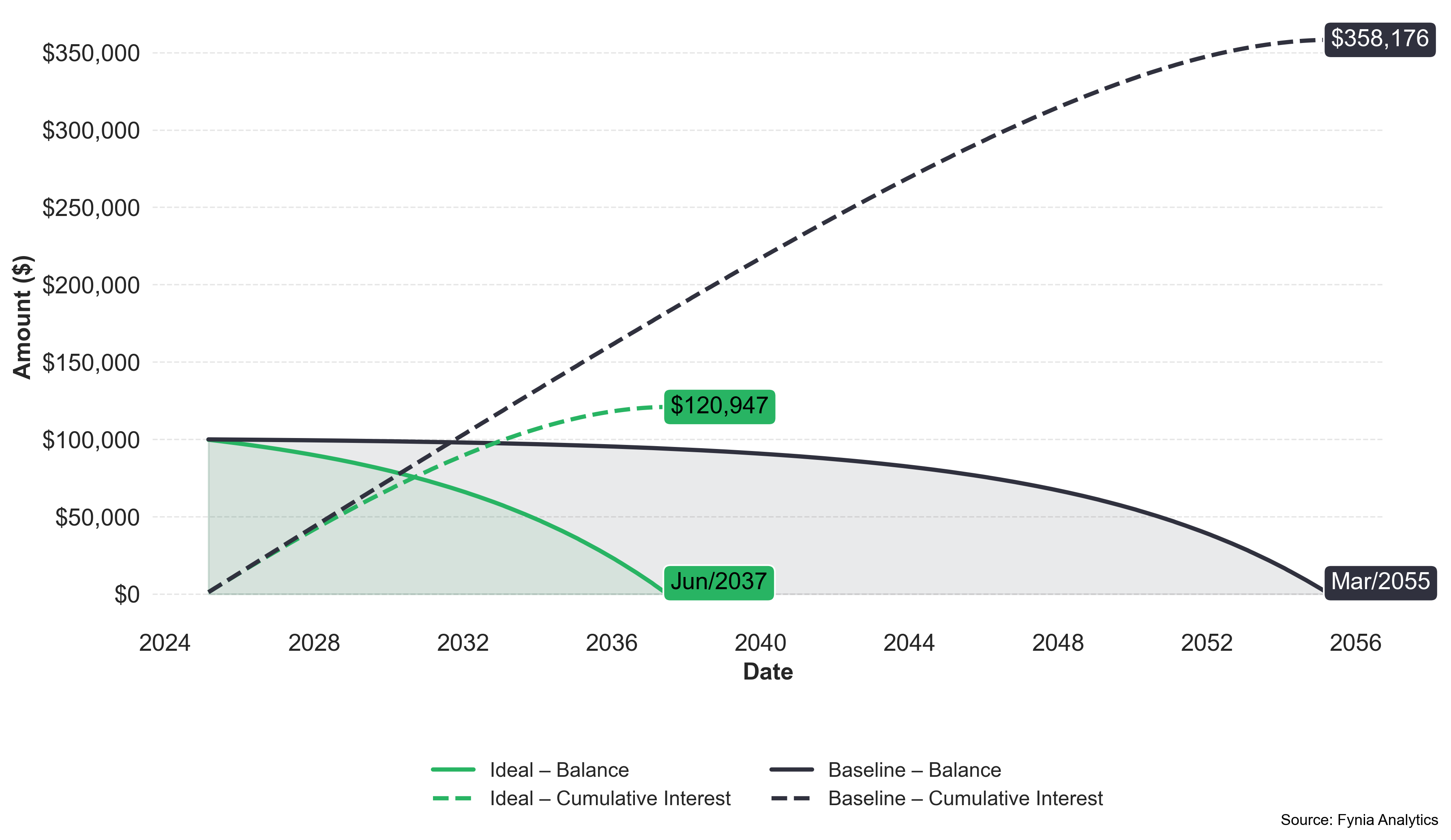

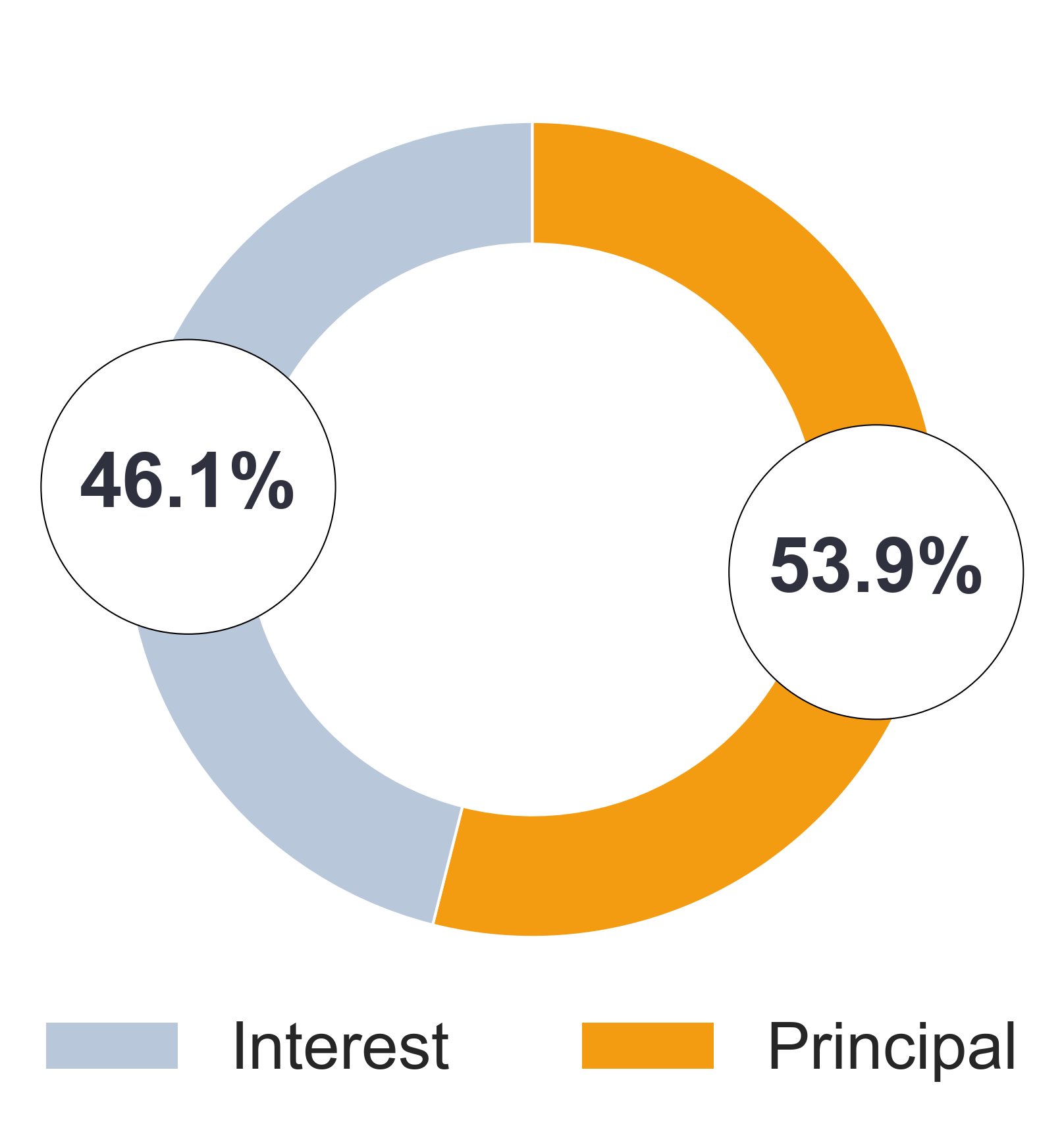

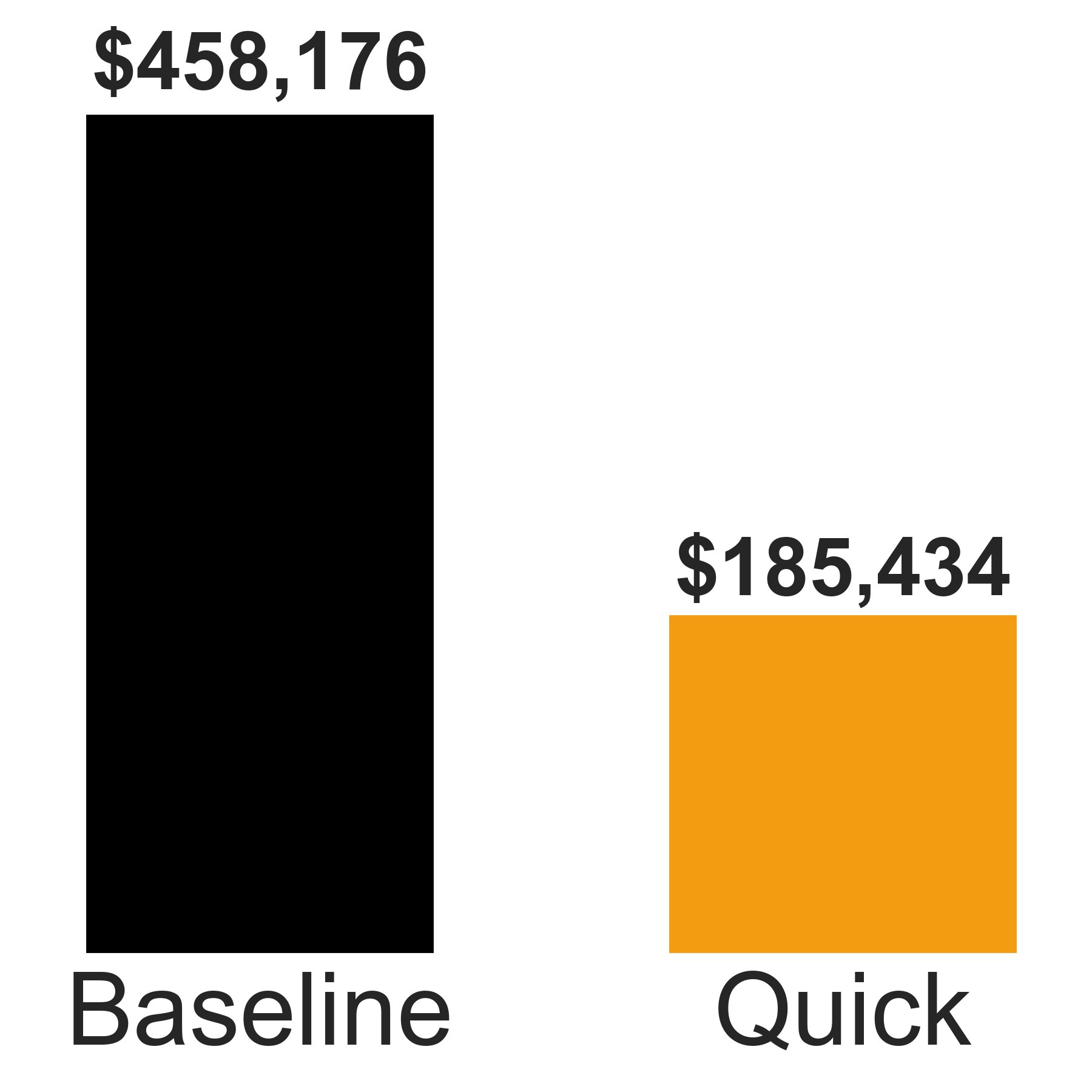

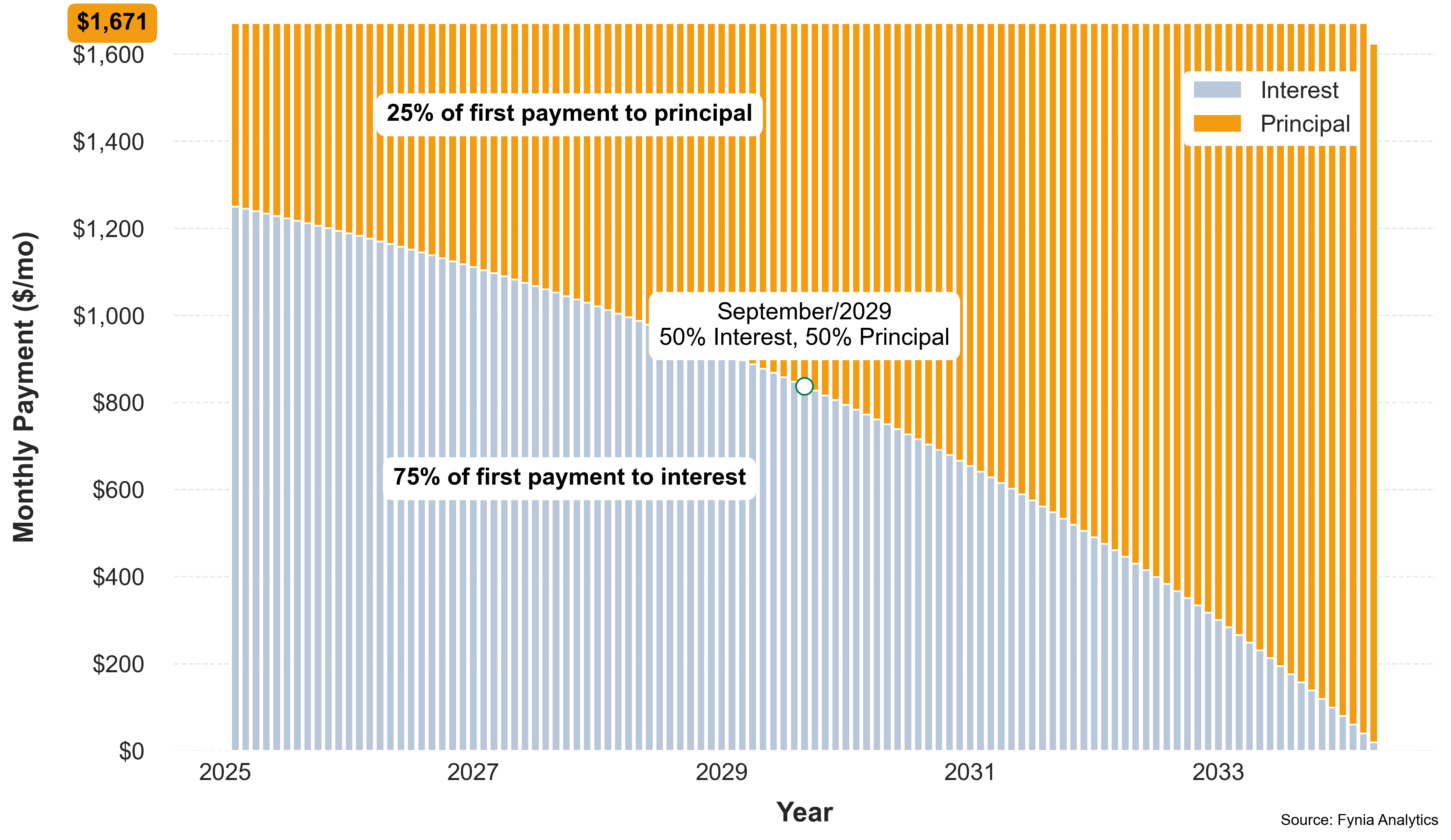

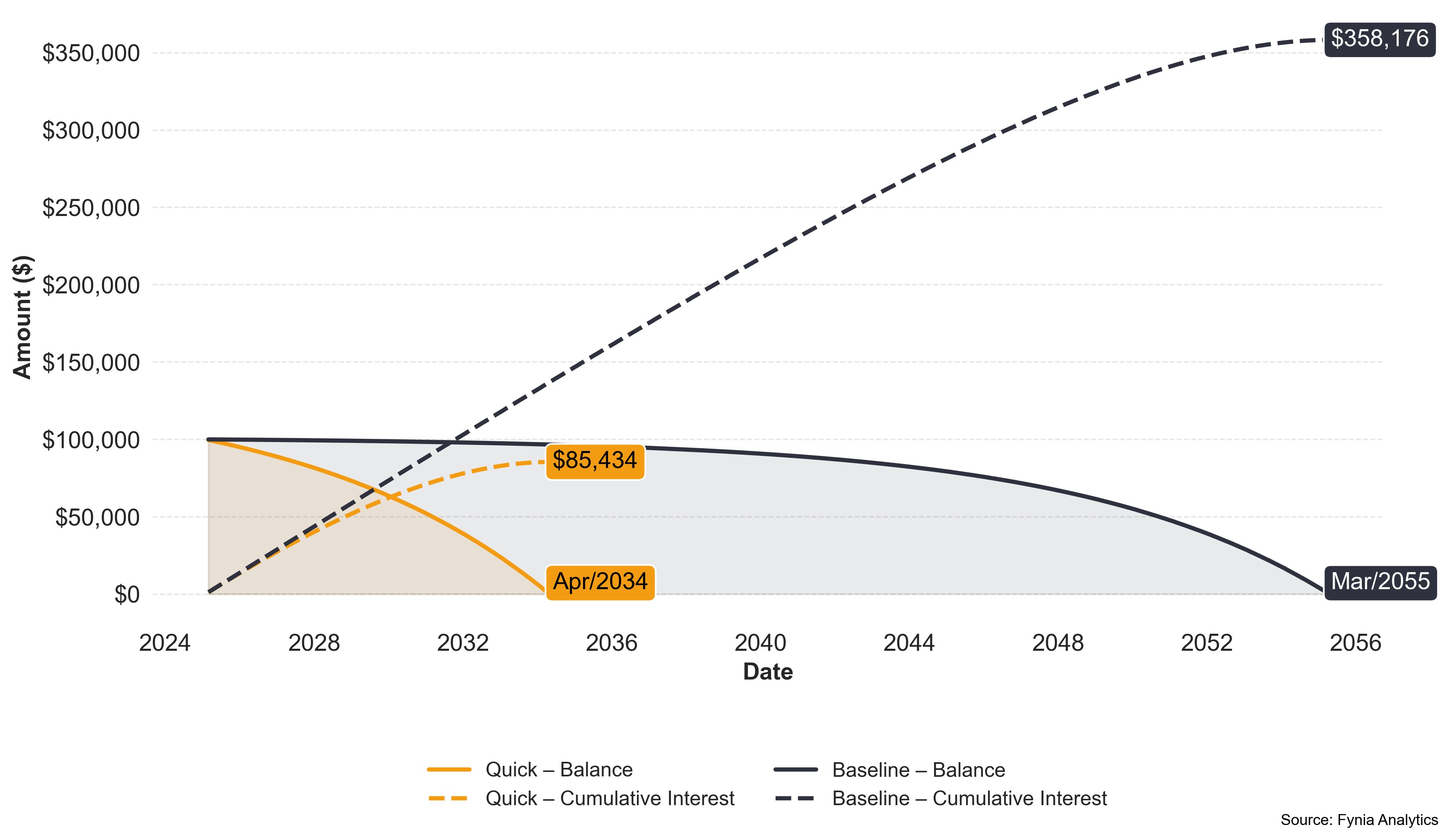

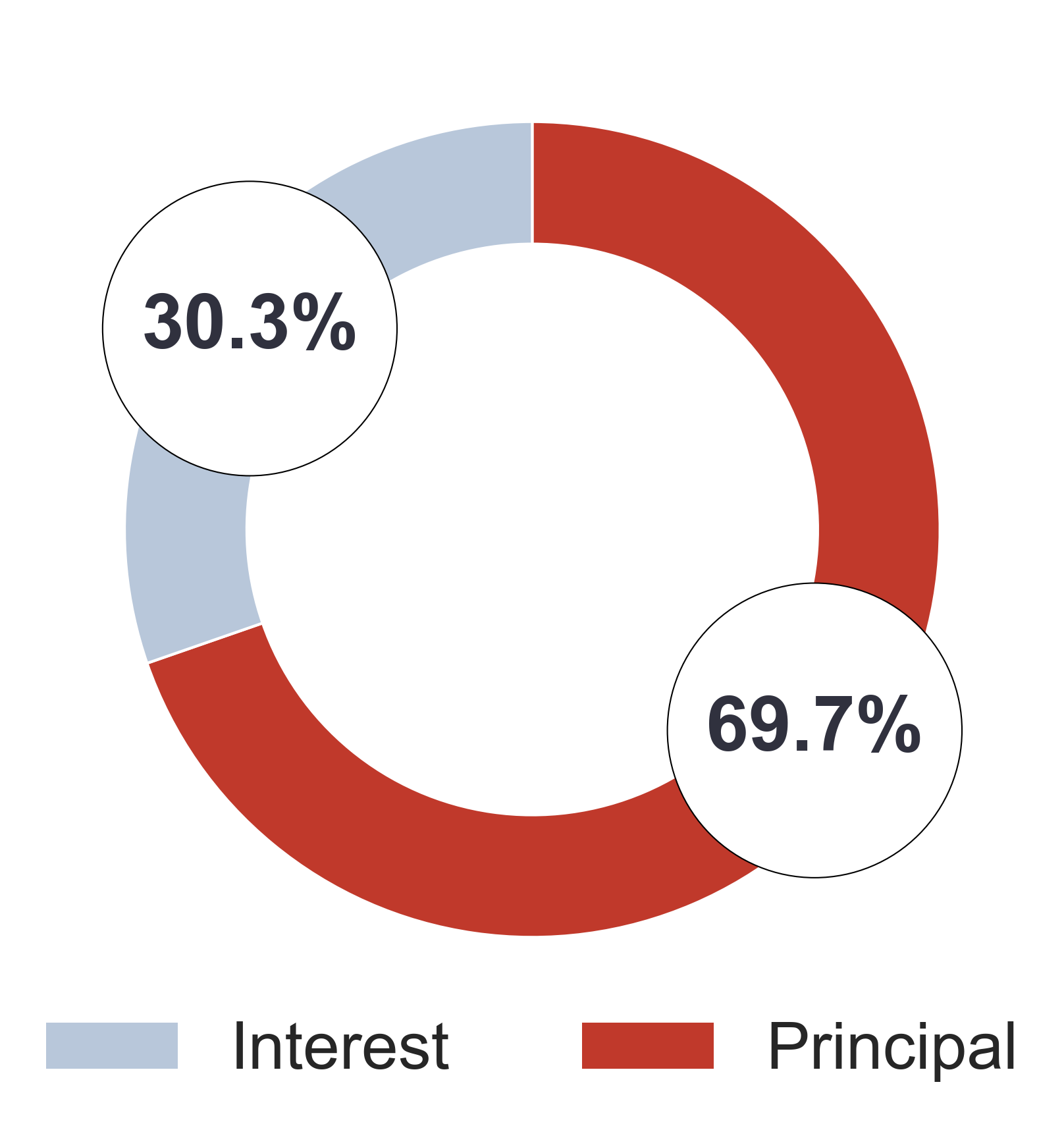

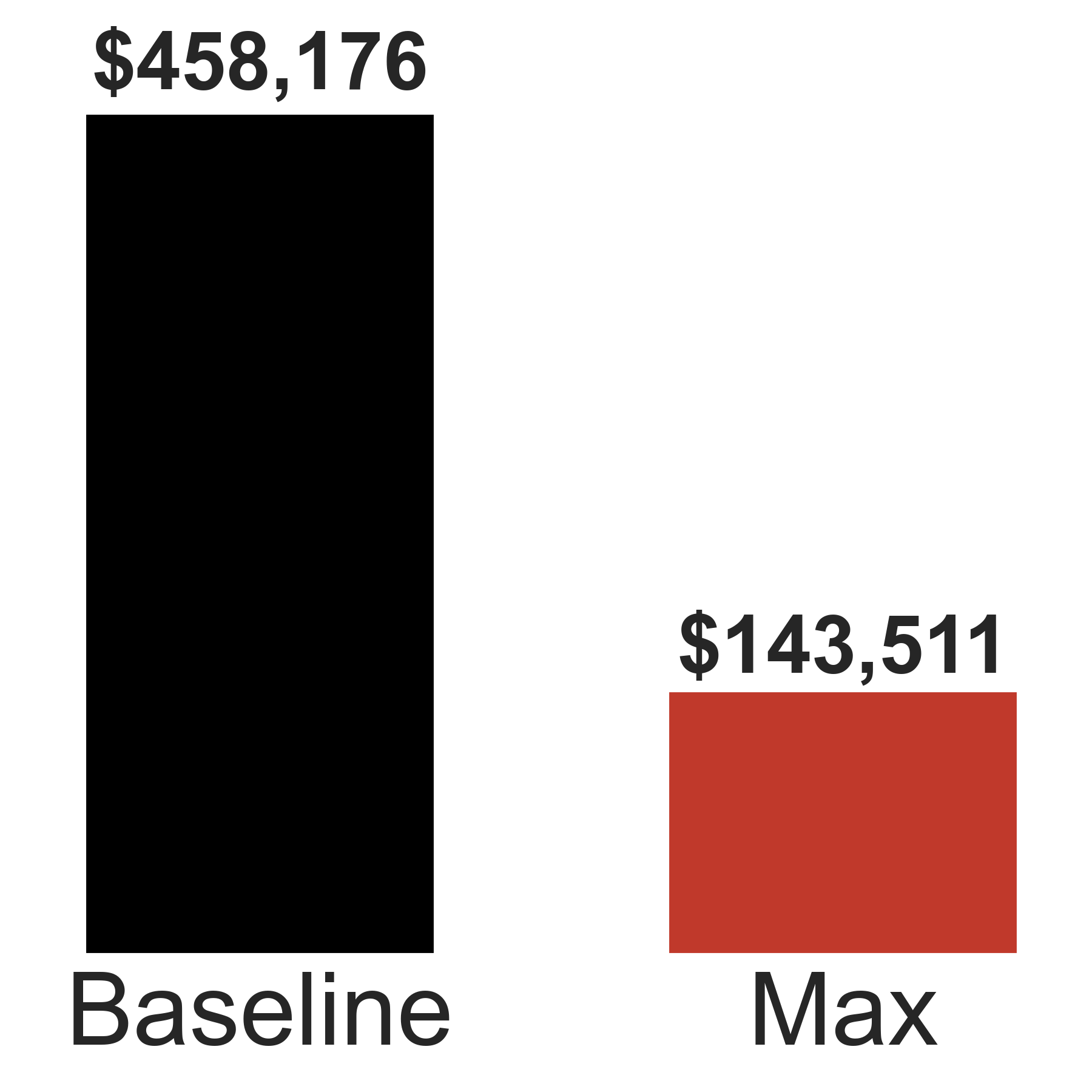

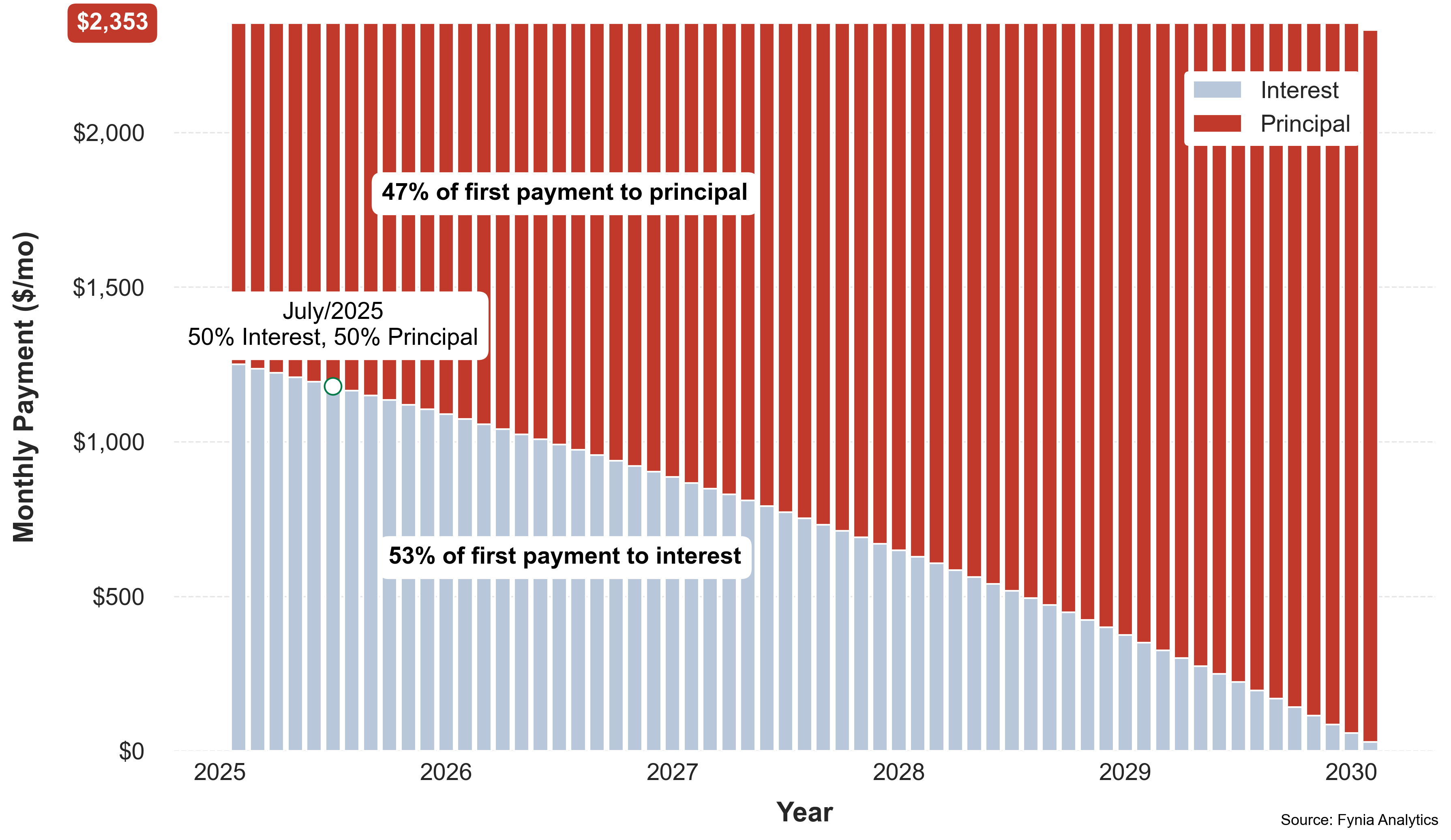

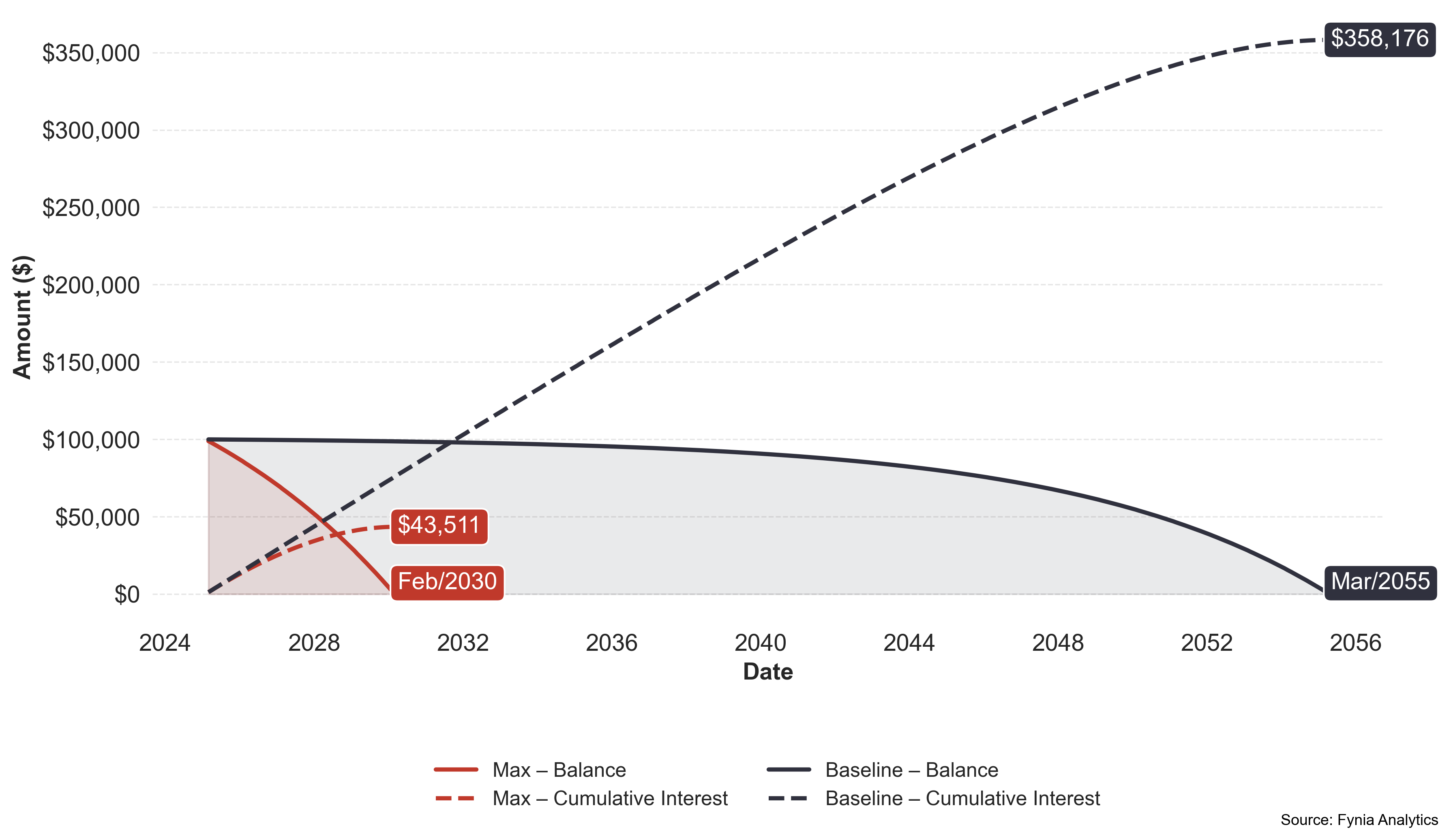

Jane has a $100,000 home loan with a 15% annual interest rate, a 30-year term, and a monthly payment of $1,264. At Fynia, we help Jane optimize her payments, maximizing savings on interest and shortening her repayment period.

Note: The following examples use January 2025 as a reference start date. Your analysis will use the specific date you enter.